maryland ev tax credit 2022

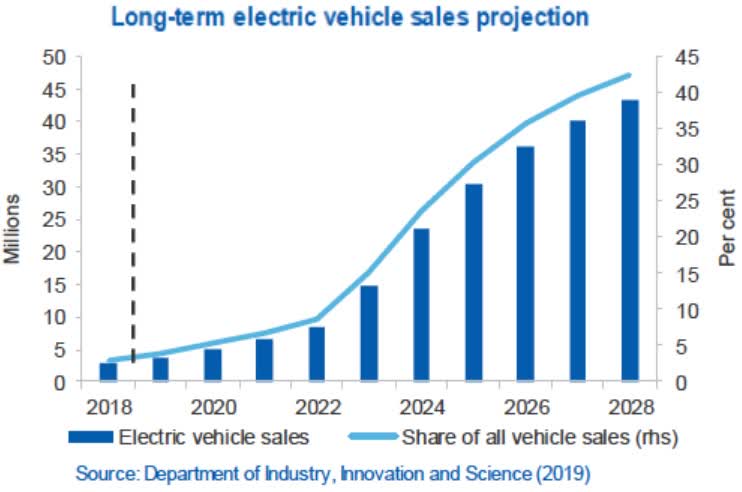

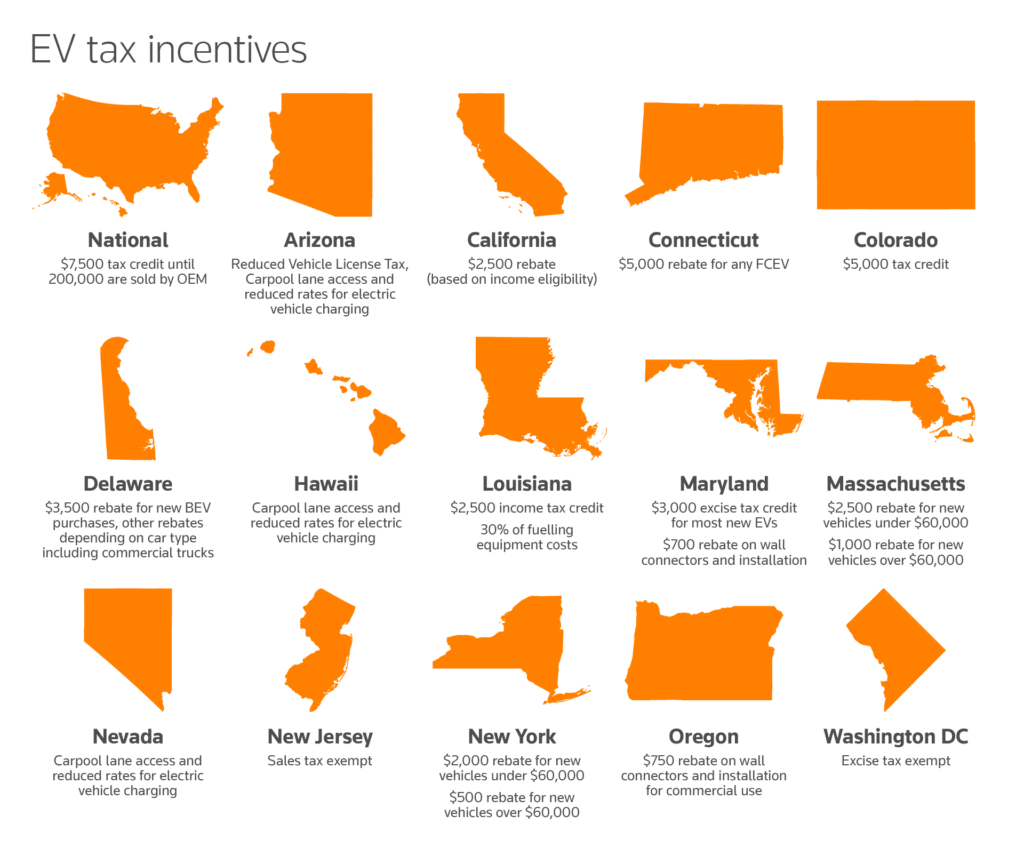

The future of driving is electric. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

Evs Of 2022 Msrp Per Mile Of Range After The 7 500 Tax Credit If Applicable Us Only R Teslalounge

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

.jpg)

. The credit ranges from 150 to 3000 depending on the vehicles battery size the larger the battery. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy Administration. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic.

Ad Here are some of the tax incentives you can expect if you own an EV car. Contact MEA regarding Maryland Energy Storage Tax Credit Tax Year 2022 by email at energystoragemeamarylandgovor by phone at 410-537-4000 to speak with Abigail Antonini. Tax Credits and Deductions for Individual Taxpayers.

Get more power than ever with Nissan Electric Vehicles. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners. Organized by the Maryland Department of Transportation MDOT Maryland Energy Administration MEA and Maryland Department of the Environment MDE we enjoy key support from a broad coalition of clean cities supporters including State agencies local and county.

Explore workplace EV charging incentives. Quality Durability Backed by Our 10 Year100000 Mile Warranty. For a period not to exceed 10.

The Renters Property Tax Credit Program similarly provides tax relief for eligible renters who pay high monthly rent relative to their total income. For updates please email us to join our newsletter follow us on social media Facebook Twitter or LinkedIn or bookmark this page or our News page. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork. Visit the Kia Official Site for More Information. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy Administration.

The ev tax credit will now be 100 per kwh of vehicle battery capacity was 125 and. And received authorization to operate from the local electric utility in Tax Year 2022 is. The Maryland Energy Administration MEA has opened the application period for the Tax Year 2022 TY 2022 Maryland Energy Storage Income Tax Credit Program.

Reduced Vehicle License Tax and carpool lane access. Up to 26 million allocated for each fiscal year 2021 2022 2023. The tax credit is available for all electric vehicles regardless of make or model and can be used to purchase the vehicle or lease it.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Decreasing from 63000 to 50000 for purposes of the electric. Up to 1000 state tax credit Local and Utility Incentives.

Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive. Decreasing from 63000 to 50000 for purposes. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and.

The majority of recipients of this credit are Marylanders aged 60 or older but the program is also available to the 100 disabled and renters under age 60 with at least one dependent child. Under the proposed Clean Cars Act of 2021. This program is designed to encourage the deployment of energy storage systems in Maryland.

Marylanders may be eligible for a one-time excise tax credit. Funding is currently depleted for this Fiscal Year. 3000 tax credit for each plug-in or fuel cell electric vehicle purchased.

In Tax Year 2021 MEA issued 164 residential and commercial tax credits certificates for energy. Ad Save on Fuel and Maintenance Costs. The Maryland General Assemblys Office of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud andor abuse of State government resources.

Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. The Electric Vehicle Supply Equipment EVSE. Please note the Maryland Energy Administration is currently developing our suite of fiscal year 2022 programs which will be launched as they are developed.

Altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles. 2022 7122- 63023. Apply for energy-efficiency improvement loans of up to 20000.

Tax credits depend on the size of the vehicle and the capacity of its battery. Electric Vehicles Solar and Energy Storage. Maryland Energy Storage Income Tax Credit - Tax Year 2022.

Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023. Owning an electric car can also be environmentally friendly substanial.

The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or purchased either individually or jointly a home in the State in the last 7 years and who has contributed money to a first-time homebuyer savings account. Ad Build Price Locate A Dealer In Your Area. Altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles.

You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Maryland Home Energy Loan Program. Maryland student loan tax credit deadline.

Residential Wind Energy Grant Program Offers Maryland residents the opportunity to install and manage their own wind energy systems. Find Your 2022 Nissan Now. Information reported to the hotline in the past has helped to eliminate.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. 1500 tax credit for each plug-in hybrid electric vehicle purchased.

Ev Tax Credit 2022 Updates Shared Economy Tax

Ev Company News For The Month Of May 2022 Seeking Alpha

Vinfast Says Preorders Will Get A 7 500 Rebate Federal Tax Credit Or Not Techcrunch

What Nissan Employees Go Through To Ensure The Best New Car Smell In 2022 Nissan Best New Cars Self Driving

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

New Employer Ui And Construction Employer Tax Rates For 2022 State Of Delaware News

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Ev Tax Credit 2022 Updates Shared Economy Tax

These Are The Few Evs And Phevs That Still Qualify For Federal Tax Credits Through 2022

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

![]()

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Toyota S Federal Ev Tax Credits Are All Dried Up

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates